Today might be an up day

Wednesday, December 19, 2018

Francisco Carneiro

0 Comments

TAGS:

From Sentimentrader:Wednesday, December 19, 2018 Francisco Carneiro 0 Comments

TAGS:

During the past 3 sessions, the number of 52-week

highs on the NYSE have made up fewer than 1.25% of new highs and

new lows. This kind of overwhelming push in new lows has been seen

on 41 days in the past 30 years. All 41 showed a higher return in the

S&P 500 over the next year, averaging 20.6%. On a medium-term time

frame, the only days with meaningful losses were 5 sessions in early

October 2008

Perhaps today the market just shots higher slowly and then faster or after the FED drop and very quickly reverse

If you are a trader sell, if you are an investor sit tight

Tuesday, December 18, 2018

Francisco Carneiro

0 Comments

TAGS:

From the Great IBDTuesday, December 18, 2018 Francisco Carneiro 0 Comments

TAGS:

The stock market autumn swoon got worse Monday after indexes undercut key levels on their charts, forcing investors to raise their defenses.

The Nasdaq composite undercut its Nov. 20 low, ending a once-promising rally. The Nasdaq closed 2.3% lower and slid further below 7000, around where support existed in late October and November. The S&P 500 lost 2.1% and tumbled below 2600, a floor that had held in the past.

With indexes falling below prior lows, IBD cut its outlook to "market in correction." This signals investors to move into cash as much as possible and as soon as possible.Reduce exposure by taking some profits. Most important, avoid buying stocks and sell any holding that falls 7% or 8% below the purchase price. Hold only the few stocks that are still outperforming and deserving of your confidence.

From my long term investments i will sell zero. Most of my holdings are in my portfolio for years and are deeply in the green.

From my trading account i am out of the market.!

Here are the five most common mistakes fund investors make, according to O'Neil:

1. Failing to sit tight.

2. Worrying about a fund's management fee, its turnover rate, or the dividend it pays.

3. Being affected by news in the market when you're supposed to be investing for the long term.

4. Selling out during bad markets.

5. Being impatient and losing confidence too soon.

one bad Idea

Monday, December 17, 2018

Francisco Carneiro

0 Comments

TAGS:

one bad idea , negative interest rates.Monday, December 17, 2018 Francisco Carneiro 0 Comments

TAGS:

if you have savings you receive zero for your savings. zero or negative

what do you do when your savings earn zero, you spend less & less you don't want to consume your capital. You lay low

The European Banking Index is destroyed trading at 91 almost at all time lows

is it possible to have a good economy with sick banks?

The European Central Bank (ECB) pushed its deposit rate to minus 0.4 percent in April 2016: Since then, euro area banks must pay 0.4 percent per annum on their excess reserves held at ECB accounts. This, in turn, has far-reaching consequences. To start with, banks seek to evade this "penalty rate," especially by buying government bonds.

Buy high and sell higher

Friday, December 14, 2018

Francisco Carneiro

0 Comments

TAGS:

Friday, December 14, 2018 Francisco Carneiro 0 Comments

TAGS:

To trade successfully, think like a fundamentalist; trade like a technician. It is

imperative that we understand the fundamentals driving a trade, but also that we

understand the market's technical s. When we do, then, and only then, can we or

should we, trade.

Dennis Gartman

The action of the market says stay out for the moment. (USD strong)

Many indicators say in 6 months the market should be higher, we must be near a bottom

I am in the camp of buying high and sell higher i will wait. i don't need to pick a bottom, to buy low and sell higher it's difficult because i never know when it's low.

1.sentiment is not making new lows. Divergence

2.Smart Money confidence is high

The Illusion

Wednesday, December 12, 2018

Francisco Carneiro

0 Comments

TAGS:

Wednesday, December 12, 2018 Francisco Carneiro 0 Comments

TAGS:

Charles Gave

I guess in Europe it does't matter where you vote you always get more taxes and more Government

Nasdaq didn't make new low yesterday!

Tuesday, December 11, 2018

Francisco Carneiro

0 Comments

TAGS:

Tuesday, December 11, 2018 Francisco Carneiro 0 Comments

TAGS:

why is this going up?

Friday, December 07, 2018

Francisco Carneiro

0 Comments

TAGS:

If a market is making a substantial move and traders seem to understand why, this market trend is not going to last very long. However, if the market is moving in one direction and nobody has a clue as to why, then the trend is going to be prolonged. When the market goes up or down for no apparent reason, it tends to go a lot further in that direction than people can imagine.Friday, December 07, 2018 Francisco Carneiro 0 Comments

TAGS:

Mark B. Fisher

When good news about the market hits the front page of the New York Times, sell.

Bernard Baruch

A good reason to buy is slow moving higher without reason. you ask why is this going up?? every time I see this I think about joining the party

Family owned companies outperform companies where CEO thinks he is the owner

Tuesday, December 04, 2018

Francisco Carneiro

0 Comments

TAGS:

Tuesday, December 04, 2018 Francisco Carneiro 0 Comments

TAGS:

My take family business don't issue tons of new shares and that is a big discipline. Professional CEO's are always asking new capital and that is very dillutive and permits big empire building and great visions.

less vision and more incremental apparently is best.

From Quartz:

Whether it’s a first-generation family start-up or a fifth-generation multi-national, family businesses outperform consistently. In particular, Non-Japan Asia and Central America are seeing young, dynamic family businesses bursting onto the scene in the emerging tech sector, while performance (although diminishing over time), remains strong in Europe and the US for older, more resilient businesses. This can be attributed to a tendency to be conservative in nature, minimizing risk where possible, giving stamina to outlast their more volatile competitors with the presence of mind to carefully balance the books.

The bottom line: Family- and founder-owned companies are outperforming their peers because they’re focused on the long-term. Not every company can operate like family businesses, but more companies can think like them.

A move without news is the Best

Tuesday, December 04, 2018

Francisco Carneiro

0 Comments

TAGS:

Again above 200 day moving average. we are not out of the woods yet. a move with news is not a high quality move. let's see what is going to happen. let the market tell us what to do.Tuesday, December 04, 2018 Francisco Carneiro 0 Comments

TAGS:

All time highs until the FED is still possible but I need to see a move without Powell or Trump/XI

If you love animals don’t miss it

Monday, December 03, 2018

Francisco Carneiro

0 Comments

TAGS:

Photo ARK is in Lisbon.Monday, December 03, 2018 Francisco Carneiro 0 Comments

TAGS:

Photo Ark is a multiyear effort with Joel Sartore to photograph all captive species and inspire people to save these animals before they disappear forever.

I love his looks ! He is not happy! ummmmm

If the markets don't go up soon we are in trouble

Friday, November 30, 2018

Francisco Carneiro

0 Comments

TAGS:

Friday, November 30, 2018 Francisco Carneiro 0 Comments

TAGS:

I am very worried about the market dynamics, it looks like we are going down. But all the data points out that good times are coming next year. (see jason Goepfert below)

i will stick to the market action. If the markets don't go up soon we are in trouble

From Jason Goepfert:

The S&P 500’s flat return in 2018 so far has been due to the growth in earnings being offset by a drop in sentiment. The price/earnings ratio for the index has declined about as much as earnings have grown, like 2011.

Like near the ends of the bear markets in 2002 and 2008.

Thursday, November 29, 2018

Francisco Carneiro

0 Comments

TAGS:

we are not at the end of a Bear market for sure! but sentiment is very bearish very negative. you don't want to sell now ......Thursday, November 29, 2018 Francisco Carneiro 0 Comments

TAGS:

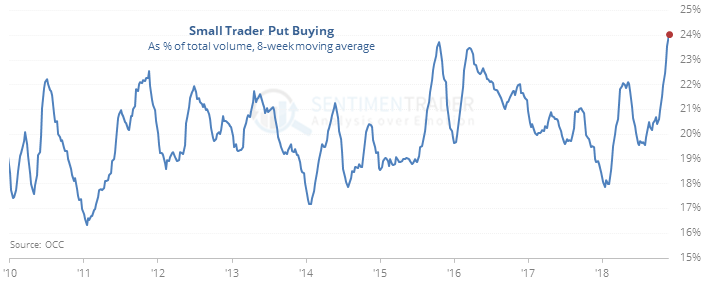

From Sentiment Trader.com

Put interest

Over the past 8 weeks, the smallest of options traders have focused so much on buying puts as a percentage of their total option volume that the only times that can match it were near the ends of the bear markets in 2002 and 2008.

Christmas Comes Early ?

Thursday, November 29, 2018

Francisco Carneiro

0 Comments

TAGS:

Thursday, November 29, 2018 Francisco Carneiro 0 Comments

TAGS:

It's stupid to be pessimistic now

Wednesday, November 28, 2018

Francisco Carneiro

0 Comments

TAGS:

I guess it's stupid to be pessimistic now when the smart money is bullish/optimistic Wednesday, November 28, 2018 Francisco Carneiro 0 Comments

TAGS:

however i will wait the action in the next few days, i want to see if the market can survive after the G20 meeting

we are not out of the woods yet

Education is the key to Progress ?

Tuesday, November 27, 2018

Francisco Carneiro

0 Comments

TAGS:

NO I don't think it isTuesday, November 27, 2018 Francisco Carneiro 0 Comments

TAGS:

USA the average is in the bottom but if they have a good top 5% it's enough

it's better to have a top elite than a top average.

YES

success in trading is inside you.....

Monday, November 26, 2018

Francisco Carneiro

0 Comments

TAGS:

Monday, November 26, 2018 Francisco Carneiro 0 Comments

TAGS:

Los que son buenos jugadores en algo lo suelen ser en casi todo.

Aitor Zarate

― Dale Carnegie

I am a great believer in this if you are good in something probably you are good in everything. that is why the small things are important do well the small things and the big things will fall in place. when someone don't put the dishes properly in the washing machine usually other areas in life are a mess.

Almost a BUY

Monday, November 26, 2018

Francisco Carneiro

0 Comments

TAGS:

Bitcoin is reaching a good buying point. USD 3000 is a good startMonday, November 26, 2018 Francisco Carneiro 0 Comments

TAGS:

I still think soon USD will go down hard (Deficits of 1 trn a year will have a price!!!) and everything will go up. stocks, bitcoins even real estate. The only way to clean huge amounts of debt is to inflate

Why Communism ALWAYS fails

Friday, November 23, 2018

Francisco Carneiro

0 Comments

TAGS:

People like to dream of striking it bigFriday, November 23, 2018 Francisco Carneiro 0 Comments

TAGS:

i sometimes dream of buying a Porsche 911 or having a Horse farm....

in Capitalism only a small number of people strike GOLD but it in communism/socialism no one does

there is no hope

everything is grey forever

just fight all the time

Black Friday was every day

Friday, November 23, 2018

Francisco Carneiro

0 Comments

TAGS:

someone send me this ! once you pass through communism usually you never go back!Friday, November 23, 2018 Francisco Carneiro 0 Comments

TAGS:

Found a funny thing, but not sure if to Poles only. In communism times (especially last 15 years) there was almost nothing in the shops, supplies were coming in erratic way, almost everything was rationed (like in war times, you had special bonus only for limited volumes of various purchases like meat, sugar, fuel, etc etc). So permanent, long queues in the shops were something very inherent to Poles' daily lives. You had the impression that you were queuing all the time, without even knowing what will come with the delivery, and if there would be sufficient amounts of that to get any chance to buy something. I found a photo from that times, accompanied with a very contemporary comment: 'In old times Black Friday was every day'

Look at the USD to see when things change.

Thursday, November 22, 2018

Francisco Carneiro

0 Comments

TAGS:

Thursday, November 22, 2018 Francisco Carneiro 0 Comments

TAGS:

Get Out Now: SocGen Releases The Most Bearish 2019 Forecast Yet

I was surprised !

Wednesday, November 21, 2018

Francisco Carneiro

0 Comments

TAGS:

Wednesday, November 21, 2018 Francisco Carneiro 0 Comments

TAGS:

Morgan Stanley CEO Says He's Not Surprised by Market Correction

- James Gorman sees impact of monetary tightening, politics

- Says Morgan Stanley well able to deal with market turmoil

(Bloomberg) --

I was surprised because the market did a breakout to new highs on October 3rd and in the same month turned down. That is not normal as as such it was a mistake not to cut risk at that time. I was wrong on that. If something is out of normal we should pay attention

now the situation is the following the Nasdaq did break the October lows (2nd graph) sentiment is improving but we are in a deep pocket of air the market can keep falling more.

The Dow and the S&P did not break the October lows yet and their graph is more constructive. Dow is down 9,75 since the all time highs.

I am looking like a fool my scenario did not pan out it doesn't look like we are going to have a rally until the FED meeting on the 19th. Usually when i look like a fool the market is about to turn however it's legitimate to cut risk NOW I am going to do it on a personal level

If the market turns around and rally's i will change course again and look like a fool......

i don't care

i know that 10 years from now the market will be much higher but the market at the moment does not look nice.

EXIT all or a bit but act

Note: if the markets have two big days up in a row with volume i will re-enter (IBD method)

All time highs before the next FOMC meeting ?

Monday, November 19, 2018

Francisco Carneiro

0 Comments

TAGS:

Monday, November 19, 2018 Francisco Carneiro 0 Comments

TAGS:

We might find a bottom soon

Wednesday, November 14, 2018

Francisco Carneiro

0 Comments

TAGS:

Wednesday, November 14, 2018 Francisco Carneiro 0 Comments

TAGS:

I think the reason for this bull market is Technology:

new ways of doing things, new cures for disease, better ways of doing more with less, self driving cars etc.... That is intact.

however if markets start going down for some reason , trump, China, Italy etc.. it could be a self fulfilling proposition so we must watch the bottom of this range. it it brakes it's better to exit.

Graph From Ciovacco Capital

If you need a beautiful moment !

Monday, November 12, 2018

Francisco Carneiro

0 Comments

TAGS:

I hope you like it !Monday, November 12, 2018 Francisco Carneiro 0 Comments

TAGS:

Anything is possible

Monday, November 12, 2018

Francisco Carneiro

0 Comments

TAGS:

Monday, November 12, 2018 Francisco Carneiro 0 Comments

TAGS:

we had a violent correction in October we should rally strongly from a correction like this. This is what i expect.

simple Rule

Friday, November 09, 2018

Francisco Carneiro

0 Comments

TAGS:

Friday, November 09, 2018 Francisco Carneiro 0 Comments

TAGS:

When Corporate spreads are below moving average, probably going down you make the most money in equities when it's above like now it starts to be dicey. I will pay attention to this.

but sometimes this is an early signal

in 2002 spreads were starting to go down because economy was in trouble and stocks lost 23% (s&p )

spreads start going up in 2006 and 2006 was still ok equities up 13%

spreads are going up in 2018 and i think it's still ok

Live like a king

Thursday, November 08, 2018

Francisco Carneiro

0 Comments

TAGS:

Thursday, November 08, 2018 Francisco Carneiro 0 Comments

TAGS:

From Bloomberg:

Greek pensioners have seen their payouts slashed so much, some of them are moving to one of the poorest countries in Europe.

Take George, 75, for example. After his wife died five years ago, he rented out his apartment in Thessaloniki, the country’s second-biggest city, packed his bags and moved to Sofia, Bulgaria’s capital, where he says his monthly 800-euro ($905) pension allows him to “live like a king.”

“Of course there are difficulties with adjusting and friends,” said George, who didn’t want to give his surname, fearing he’ll be pursued by Greek tax authorities. “But with the money I have, I can return to Greece often, and I also have the opportunity to travel.”

Greece, which is among retirement destinations for other Europeans, is finding its own citizens -- like George -- are now looking to live out their senior years in the country’s cheaper northern European Union neighbor after seeing their pensions cut at least 20 times during its protracted debt crisis.

Coast is clear

Thursday, November 08, 2018

Francisco Carneiro

0 Comments

TAGS:

I think we have the conditions to reach the all time high in November. there is going to be a rush to buy, lot's of people are behind now.Thursday, November 08, 2018 Francisco Carneiro 0 Comments

TAGS:

after that we might have the melt up scenario in 2019.

With so many people still fearful how can this possibly be a final top?

Wednesday, November 07, 2018

Francisco Carneiro

0 Comments

TAGS:

Wednesday, November 07, 2018 Francisco Carneiro 0 Comments

TAGS:

The end of the Party?

Monday, November 05, 2018

Francisco Carneiro

0 Comments

TAGS:

Monday, November 05, 2018 Francisco Carneiro 0 Comments

TAGS:

IF QE was very bullish for the asset prices the end of QE from mid 2019 should do the opposite? As you know i think we might have a climax before the end! a melt up. i don't see euphoria in this bull run.why should equities go up?because good times bring more good times in a Virtuous cycle

From Chris Solarz, Cliffwater Weekly Macro News

If you are thinking about buying equities now it's a good time

Friday, November 02, 2018

Francisco Carneiro

0 Comments

TAGS:

Friday, November 02, 2018 Francisco Carneiro 0 Comments

TAGS:

Chop until Elections and then.............

Friday, November 02, 2018

Francisco Carneiro

0 Comments

TAGS:

Friday, November 02, 2018 Francisco Carneiro 0 Comments

TAGS:

― William H. McRaven

Best place to live in the South of Europe 2018 stats

Tuesday, October 30, 2018

Francisco Carneiro

1 Comments

TAGS:

Madrid, in Madrid people get 96% of things an average NY can get. In Greece life is difficultTuesday, October 30, 2018 Francisco Carneiro 1 Comments

TAGS:

Are we Smart Money ?

Tuesday, October 30, 2018

Francisco Carneiro

0 Comments

TAGS:

Tuesday, October 30, 2018 Francisco Carneiro 0 Comments

TAGS:

Notes for Tuesday

Tuesday, October 30, 2018

Francisco Carneiro

0 Comments

TAGS:

ECONOMICS

Tuesday, October 30, 2018 Francisco Carneiro 0 Comments

TAGS: ECONOMICS

0.“If cash flows and expected growth have not changed over the month, the price of equity risk has jumped from 5.38% at the start of the month to the 5.89% on October 26, putting it at the high end of equity risk premiums in the last decade.

3.From Clifwater Weekly

(Brazilian Macro Manager #1) Long, then Short BRL: Far-right populist Jair Bolsonaro is widely expected to defeat his left-wing opponent Fernando Haddad in the nation’s final presidential vote on Sunday. Bolsonaro’s win will lead to a nice bounce, and which will be nice entry point to short BRL. Bolsonaro’s honeymoon period won’t last long – he’s political unsavvy, congress remains very fragmented, and Brazil faces considerable fiscal headwinds. This will ultimately lead to downward pressure on the BRL and Brazilian equities

4.Price of Power in Europe

My country Portugal despite being one of the poorest have one of the highest prices of Power in Europe, 0,22 per kwh above the European average 0,2!

I don’t see a recession anytime soon

Monday, October 29, 2018

Francisco Carneiro

0 Comments

TAGS:

ECONOMICS

in 1987 the year i started working in the stock exchange doing research stock's (S&P) were 19% above the 200 day moving average, a bit too much. after the crash they were 28% below the average.Monday, October 29, 2018 Francisco Carneiro 0 Comments

TAGS: ECONOMICS

After than the Bull market continued until 2000 with a big scare in 1998.

what is happening now?

I don’t see a recession anytime soon so I see this market correction as a “correction” and not a Bear market. We were 7% above the 200 day moving average at the end of September and now we are 5% below the 200 day moving average on the S&P. Is the correction done? i don't know but some steam was liberated from the stock market. we are ready for the next leg up.

When the FED is hiking ok but when FED lowers careful.....

Monday, October 29, 2018

Francisco Carneiro

0 Comments

TAGS:

ECONOMICS

Monday, October 29, 2018 Francisco Carneiro 0 Comments

TAGS: ECONOMICS

From Bull Market's

The stock market tends to go up 1-6 months after the Federal Reserve stops hiking interest rates. Here are the S&P 500’s forward returns after the last rate hike in each rate hike cycle.

I cound not get the numbers of what happen to stocks after the first cut in interest rates but i know it's down big time. normally the FED is trying so save the market and the economy . in the first 6 monhs after the first cut get out of the market

conclusion:

1. during the FED hikes OK

2.After the FED stop hiking until the first cut Dangerous but could be OK

3.in the first 6 months after the first cut . Stay far away from stocks

Popular Posts

Blog Archive

-

▼

2018

(163)

-

▼

December

(13)

- If the dollar does the unthinkable and begins to c...

- Today might be an up day

- If you are a trader sell, if you are an investor s...

- one bad Idea

- Buy high and sell higher

- The Illusion

- Nasdaq didn't make new low yesterday!

- Sniffing a recession

- why is this going up?

- Here we go again

- Family owned companies outperform companies where ...

- A move without news is the Best

- If you love animals don’t miss it

-

►

November

(23)

- If the markets don't go up soon we are in trouble

- Like near the ends of the bear markets in 2002 and...

- Christmas Comes Early ?

- It's stupid to be pessimistic now

- Education is the key to Progress ?

- success in trading is inside you.....

- Almost a BUY

- Why Communism ALWAYS fails

- Black Friday was every day

- Look at the USD to see when things change.

- I was surprised !

- All time highs before the next FOMC meeting ?

- I am starting to be worried about the markets! umm...

- We might find a bottom soon

- If you need a beautiful moment !

- Anything is possible

- simple Rule

- Live like a king

- Coast is clear

- With so many people still fearful how can this pos...

- The end of the Party?

- If you are thinking about buying equities now it's...

- Chop until Elections and then.............

-

▼

December

(13)

0 comentários: