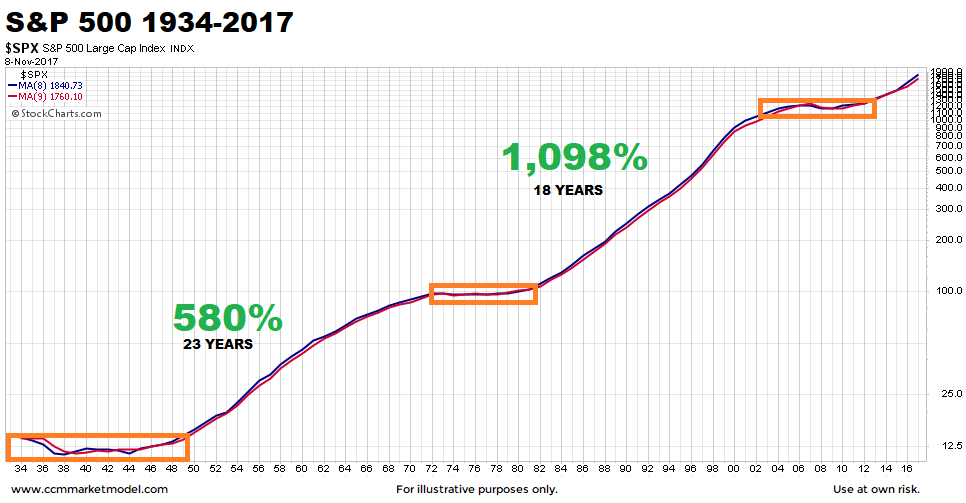

Why should stocks go higher from an already high level?

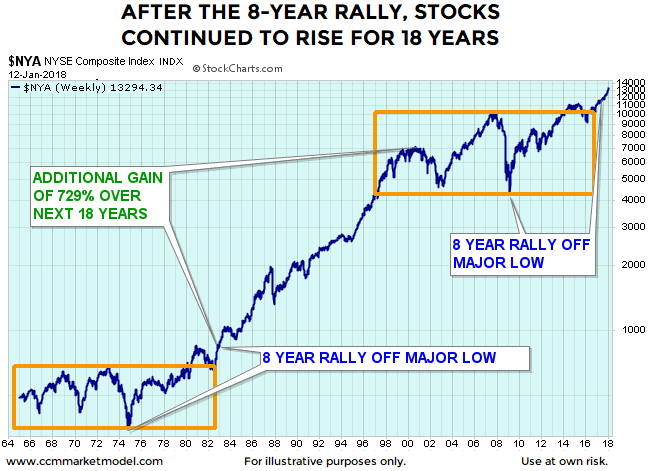

Nasdaq just had a 17

year consolidation! In 2000 it reached 5000 points in 2017 it surpassed again

5000. Can it go higher. I guess yes. Why should stocks go higher from an already high level?

a)because that is what

usually happens. (higher highs keep coming one after the other)

b)perhaps the

productivity shock form the internet is going to be felt 20 year after the

introduction

c)perhaps there is less

and less supply of equities (number of listed equities keeps falling)

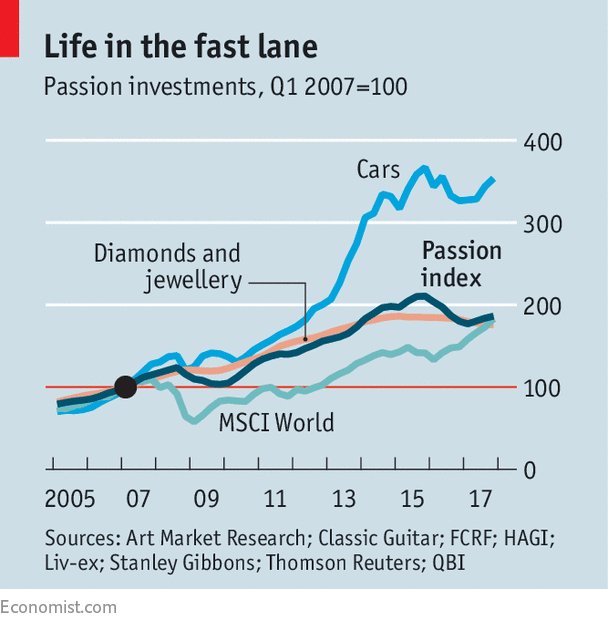

d)perhaps there is too

much money chasing opportunities

e)perhaps the markets

are feeling that the pace of progress is increasing (half of all patents in

history have been filed in the last 10 years (I just came up with this number from

my head but could be more a less correct))

………………..

Perhaps the low for

2018 is in, 9th of February last Friday.

It’s not always a Bull

Market

Enjoy the Bull and the

weekend

more about the same:

0 comentários: