When winners are taking all, it's often time to buy the winners

Disturbing New Facts About American

Capitalism

When winners are taking all, it's often time to buy the

winners

JASON ZWEIG

Mar 3, 2017 8:41 am ET

“Let

your winners run” is one of the oldest adages in investing. One of the newest

ideas is that the winners may be running away with everything.

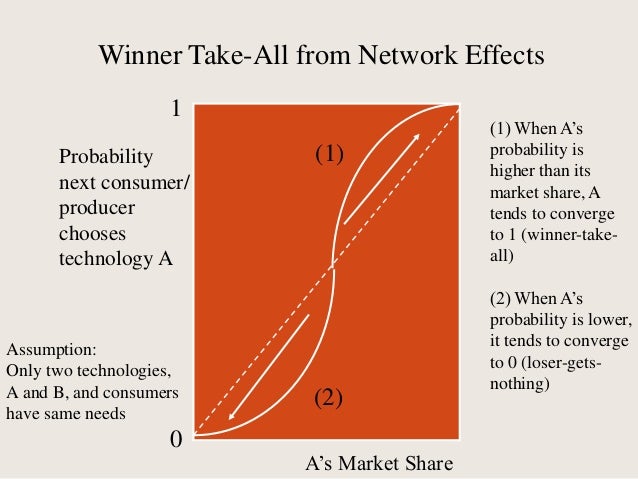

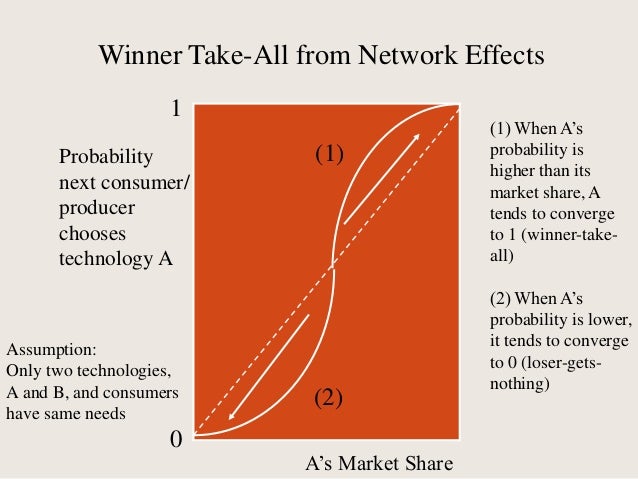

Modern capitalism is built on the idea that as companies get big, they

become fat and happy, opening themselves up to lean and hungry competitors who

can underprice and overtake them. That cycle of creative destruction may

be changing in ways that help explain the seemingly unstoppable rise of the

stock market.

New research by

economists Gustavo Grullon of Rice University, Yelena Larkin of York University

and Roni Michaely of Cornell University argues that U.S. companies are moving

toward a winner-take-all system in which giants get stronger, not weaker, as

they grow.

That’s the latest among several recent studies by economists working

independently, all arriving at similar findings: A few “superstar firms” have

grown to dominate their industries, crowding out competitors and controlling

markets to a degree not seen in many decades.

Consider real-estate services. In 1997, according to Profs. Grullon,

Larkin and Michaely, that sector had 42 publicly traded companies; the four

largest generated 49% of the group’s total revenues. By 2014, only 20 public

firms were left, and the top four — CBRE Group, Jones Lang LaSalle, Realogy Holdings and Wyndham Worldwide — commanded 78% of

the group’s combined revenues.

A friend from São Paulo called my attention to this nice piece from Jason Zweig in the WSJ. Yes in the last 5 years Big get Bigger has been the main trend. USA and Germany have been the big winners for the simple reason that they already dominated many spaces.

Economies of scale have always been a sure way to profits. easier than R&D. if the big guys also invest wisely in R&D they become unstoppable. On the marketing side economies of scale were always huge. Santander can advertise worldwide because they are almost a global brand. For a local company why advertise worldwide?

From today Bloomberg

Peugeot Maker PSA Agrees to Buy GM’s European Brands in $2.3 Billion Deal

Agrees to Buy GM’s Opel Unit

PSA Group is betting that size is the answer in Europe’s saturated car market as it buys General Motors Co.’s ailing regional division despite years of losses.

The maker of Peugeot and Citroen cars will pay 1.8 billion euros ($1.9 billion) for GM’s Opel unit and its U.K. sister brand Vauxhall, as the French manufacturer bolsters its defenses in a peaking market that’s being transformed by technology, new competitors and Brexit. GM, which is taking a charge of between $4 billion and $4.5 billion, will retain a toehold in the area by continuing to sell Chevrolets in small volumes.

The maker of Peugeot and Citroen cars will pay 1.8 billion euros ($1.9 billion) for GM’s Opel unit and its U.K. sister brand Vauxhall, as the French manufacturer bolsters its defenses in a peaking market that’s being transformed by technology, new competitors and Brexit. GM, which is taking a charge of between $4 billion and $4.5 billion, will retain a toehold in the area by continuing to sell Chevrolets in small volumes.

0 comentários: