stayin’ home

American kids are stayin’ home these days. We knew that from anecdotes but now we know it given the hard data from the Census Bureau.

Unable to find jobs commensurate with their educations,college graduates are becoming what some are now calling “Generation Wait” and are bunking down with parents, or are joining up with friends in small apartments and condominiums, but clearly they are not out forming new housing units on their own.

They are delaying careers; they are certainly delaying marriages and they are delaying having children. We know this because the census bureau has reported that a historically low 23.3% of those Americans between the ages of 25-29 moved in the twelve months ending in March of this year. That is down from 24.6% the year previous and it is the lowest level since ’63! Indeed, the trend has been down since ’65 when a record 36.7% of those between those ages then moved. Generation Wait… that is precisely what is happening; they are waiting… and waiting and waiting… and….

Dennis Gartman from TGL one of the besd daily newsletters

It's not the 2008 Financial crisis, it's not the Banks fault, it's not the lack of regulation, it's not China, it's not the politicians the true is that the world doesn't need everybody to produce everything. Automation, mechanization, etc... make a lot of people expendable/without normal jobs.

A person operating a machine can produce for 10,000 people. We are inventing new necessities/needs that didn't exist some years ago but many are very tech intensive and low labor intensive. (New games & apps ).

What to do?

1.Participate in the automation movement, became a programmer of software engineer. Make good money

2.Do something manual that cannot be done by a machine. Barber, therapist, personal trainer, chef, bike mechanic, etc.... make little money

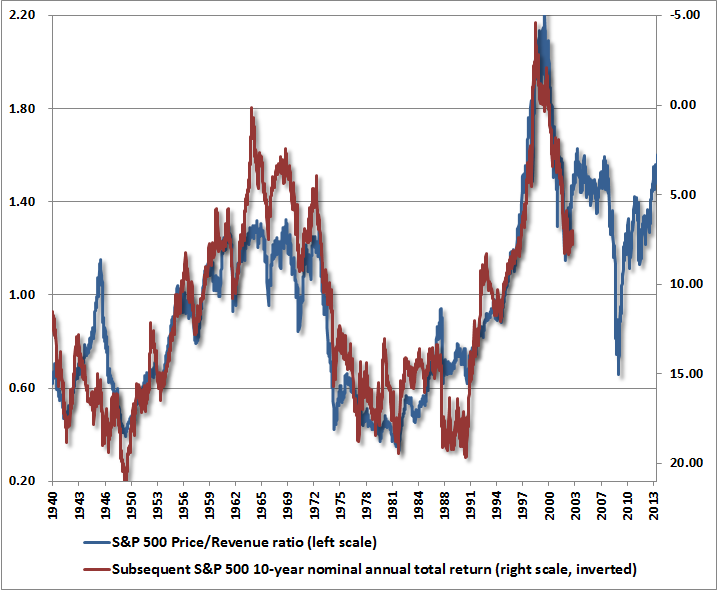

3.Invest in the Robotization/Automation. Participate and profit from it. If you are going to be replaced by a machine be a shareholder of the machine company

4.Be nice. There will always be demand for the personal touch.

5.Travel a lot cheaply and observe/learn.

6.Read the classics, nothing changes.

7.Don't let other people serve you, it's too expensive. Serve & charge for it, let others pay.

8.Be a regulator or police officer, there is a bull market for Government everywhere. If you like it (Not me) do it.

9.Do sports & meet lot's people

What not to do

1.Get into debt to take a useless diploma

2.Tell your kids that if they are good students they made it. It's not enough. That is why kids are staying home with their parents.

0 comentários: