Are there places where the best always(almost) win!

Why doesn’t fund management

conform to the rules of professional sports, where athletes such as Cristiano

Ronaldo or Roger Federer consistently outperform their rivals? One reason could

be that successful managers attract more clients, and the size of their fund

grows. So they have to expand the number of stocks they buy, diluting their

best ideas. As the fund grows larger, it looks more likely the overall market,

and runs into the iron law of costs.

Buttonwood, The Economist

24th June

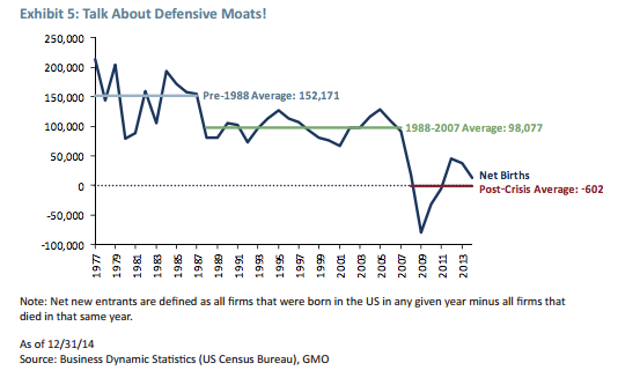

We know that in the financial markets and Fund management there is for sure short term persistence or momentum. However long term persistence is non existent. In sports it's not only Cristiano Ronaldo, Federer and Froome that show above average quality year in and year out. In Chess usually the highest rankling playear almost always wins.

In Fund management The Economist has this to offer

Active fund management may have more of a role to play in other places: emerging markets, for example, where information about the prospects of individual companies is not so widely available...

In my experience there is two ways to do consistently well, to have a better mouse trap (very difficult but possible) there are companies/Managers that invest more in R &D and have secrets and there are spaces where the information is difficult to get (There is no Bloomberg with everything easily available) and the true specialist that has the database that no one has can demonstrate a persistent advantage. (Emerging Markets, small cap's , and even in the Bond world we see some persistence......

0 comentários: