What is this Blog About?

I don't know perhaps the people who visit it can say better than me but I have a few ideas that keep coming over and over.

1.Capitalism is the only system that makes people happy. Socialism is not a system society is destroyed (Venezuela etc....). To treat people like weak and vulnerable that must be helped never works.

2.The Good old days were no Good

3.Eat less, eat very little if you can. Zero Sugar.

4.Best thing for the brain is exercise, physical exercise is the best.Brain exercise a distant 2nd best.

5.Eat meat, be like a MASAI, meat & Exercise.

6.All this radical ideas of changing what is working is just stupid. I am a conservative.

7.Have a philosophy of whatever comes it's ok. If you have this view of life you will be happy. Anything and everything don't make plans just enjoy and adapt.If things change it's ok never try to go back. it's over let's move on.

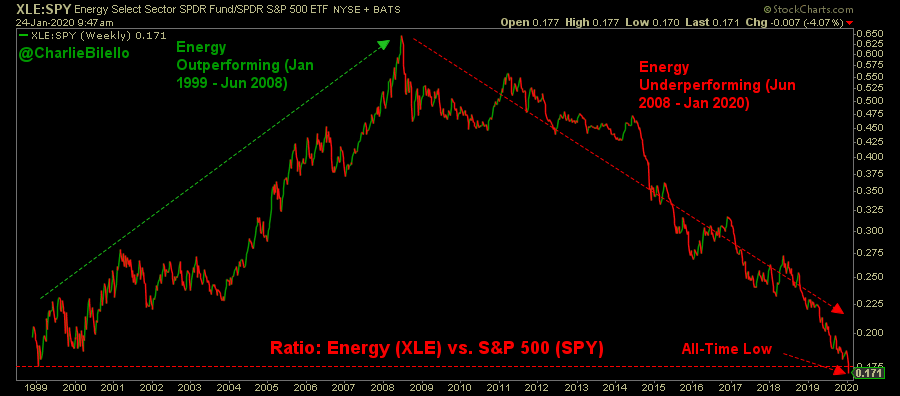

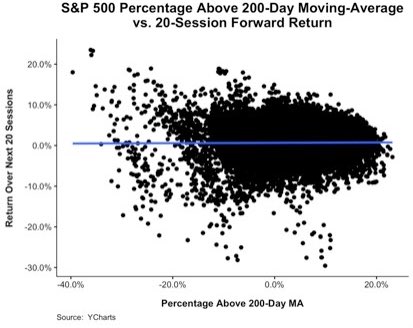

8.In my business some people confuse past experience is no guarantee of future results which is partially true with past experience does not matter. It matters a lot. In fact recent results are a great indication what is coming next.

9."In three words I can sum up everything I've learned about life: it goes on."

Robert Frost

10.It doesn't matter. Most of the things don't matter at all. It's just noise.Enjoy. Stop listening to news.

11.The person who works hard and is organized (FOCUS) normally does better in life than the high IQ smart person. Don't over complicate things.

0 comentários: