Money is pretty good predictor of who will win elections

Wednesday, July 31, 2019

Francisco

0 Comments

TAGS:

What do the numbers really tell us? These two stats jumped out at us from a post-analysis done by the Center for Responsive Politics:Wednesday, July 31, 2019 Francisco 0 Comments

TAGS:

– 94 percent of biggest spenders in House races won, up slightly from 2012

– 82 percent of biggest spenders in Senate races won, up from 76 percent in 2012

From Washington Post

91% of the time the better-financed candidate wins. Don’t act surprised.

The chart analyzes 467 congressional races held in 2012. Its findings:

* Candidates who out-fundraised their opponents were nine times more likely to win elections in 2012.

* Winning congressional candidates outspent their opponents by about 20 to 1.

* Winning candidates on average spent $2.3 million. Losing candidates, on average, spent $1.1 million.

More money generally means more wins

Wednesday, July 31, 2019

Francisco

0 Comments

TAGS:

This doesn't surprise me, Miracles are rare. The biggest budget can buy the best data and the best people and the result usually is more win's. simpleWednesday, July 31, 2019 Francisco 0 Comments

TAGS:

The line gets steeper going from left to right, implying that in recent seasons, jumps in salary have been associated with larger gains in win percentage. Altogether, none of the 20 teams with the highest relative salaries since 1985 have finished below .500.

J.C. Bradbury, an economics professor at Kennesaw State University, found that winning more increases revenue exponentially. “Going from 85 wins to 90 is worth more than 80 wins to 85,” he says. As a result, while it might cost more per win for a team that wins 90 games than 85, it makes financial sense because the revenue reward will be higher as well. This leads to a self-perpetuating cycle.

https://fivethirtyeight.com/features/dont-be-fooled-by-baseballs-small-budget-success-stories/

The Case for 50bps

Tuesday, July 30, 2019

Francisco

0 Comments

TAGS:

Tuesday, July 30, 2019 Francisco 0 Comments

TAGS:

A strong policy response is necessary to guard against risks of a further, sharper loss of economic momentum. Weak incoming data, lingering trade tensions, and preventing both financial conditions from tightening and a non-linear adverse impact on growth are key reasons for a front-loaded adjustment.

Chetan Ahya

MS CHIEF ECONOMIST AND GLOBAL HEAD OF ECONOMICS

Economics 101 lesson 3

Monday, July 22, 2019

Francisco

0 Comments

TAGS:

Bull markets tend to sprint to the finish lineMonday, July 22, 2019 Francisco 0 Comments

TAGS:

BCA research

Bull markets deliver most of the gains at the end, don't sell too early

Economics 101 lesson 2

Monday, July 22, 2019

Francisco

0 Comments

TAGS:

“Crises take longer to arrive than you can possibly imagine, but when they do come, they happen faster than you can possibly imagine.”Monday, July 22, 2019 Francisco 0 Comments

TAGS:

Rüdiger "Rudi" Dornbusch (June 8, 1942 – July 25, 2002) was a German economist who worked for most of his career in the United States

Don't jump the gun wait for blood and then run for cover....

Economics 101 lesson 1

Sunday, July 21, 2019

Francisco

0 Comments

TAGS:

Keep in mind that the U.S. dollar is a counter cyclicalSunday, July 21, 2019 Francisco 0 Comments

TAGS:

currency, meaning that it moves in the

opposite direction of global growth

Peter Berezin, from the great BCA

when we see the USD falling is a great sign for the world.

I did warn in advance now its a bit too late

Saturday, July 13, 2019

Francisco

0 Comments

TAGS:

The Federal Reserve's chairman, Jerome Powell, just described bitcoin as a "speculative store of value" like the way gold is used.Saturday, July 13, 2019 Francisco 0 Comments

TAGS:

Bitcoin is out of the news the small investor is completely out, only institutional investors are participating now.

One bitcoin already cost more than USD 10,000 some people just miss the opportunity to own a bitcoin in their life.

I want to thank my first five clients

Friday, July 12, 2019

Francisco

0 Comments

TAGS:

I am running my own Financial consulting business since February. I registered the name Lisbon Family Office and asked for a license in the national regulator.Friday, July 12, 2019 Francisco 0 Comments

TAGS:

I thought that to run a company you have to have a vision and think long term and do big projects.

I do have a vision (I expand on it later) but since the start i am solving problems every day, everyday i have a to do list and I just run trough it.

I got the license

I work in a very nice office with great people

after 5 months i have 5 clients that guarantee my business viability.

Most of my clients are outside Portugal and are very sophisticated, demanding and successful clients. My clients did very well in life they are winners all of them.

From now on i will charge more for new business. I did a really low price to start and i did star fast.

And as i said my life since February has been solving problems everyday

getting an email running

getting a Microsoft Cloud licence

getting a team

getting a logo

getting computers

getting a place to work

getting the license

getting the best lawyers

getting the best compliance

getting the best accounting

getting a Bloomberg

getting quality paid research

and finally getting the best clients.

now back to the vision my vision is in my logo

There is always a bull market in the world

I believe there are easy things to do and difficult things to do. I tend to search for some wind in the back. I find a good business when almost or all the players in a space are doing ok or good. A business where the pie is expanding and eventually find the people that are getting a bigger share of that expanding pie.

That is my vision but sometimes clients just want to solve problems with speed and some intelligence with no vision. I am here to do that too. Solve small problems and leave the big problems for a later time.

I want to thank my first five clients.

I saw this in a Blog ( Gary Mishuris at Forbes)

· Don’t

believe management’s projections, but rather rely on evidence of actual

accomplishments

· Spend

time understanding the quality of the business rather than getting lost in the

financials. Some businesses are tougher than others and they are likely to

remain so beyond the next quarter.

· Don’t

get overconfident because you know a lot of details about the business – it’s

the few big things that matter

Why the fed is going to cut ......

Thursday, July 11, 2019

Francisco

0 Comments

TAGS:

Thursday, July 11, 2019 Francisco 0 Comments

TAGS:

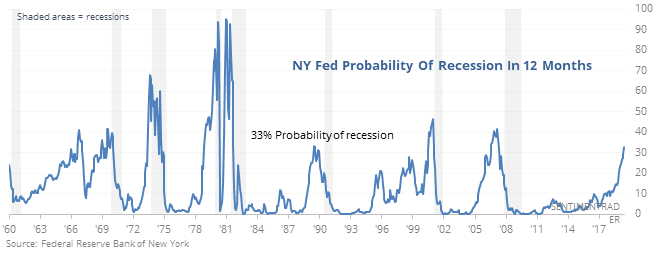

Europe is already in a recession US will have one probably mild in the Q4 2019 i think the Fed is late.

Bonds are already sniffing something. Bond traders are sharper

it's a pity Draghi is at the end of the mandate otherwise i think stocks QE could be a possibility

What if the ECB starts buying stocks

Tuesday, July 09, 2019

Francisco

0 Comments

TAGS:

Tuesday, July 09, 2019 Francisco 0 Comments

TAGS:

I have one thought

If S&P enters a bear market what happens to Europe that is already (part of Europe, banks etc....) in a bear market?

I think a lot about this. I have been in a bull market in my life but i had no capital, from 1988 to 2000! Now a big part of the world is not in a bull market is just exiting a big hole very slowly

of course anything is possible but if we enter a bear market in USA it's better to hide and buy some cans of sardines. and this is a serious possibility since the 1H 2019 the market is already up 17% so the upside of S&P is limited.

what to do? Expect central banks to do everything to inflate, to reflate to wake the animal spirits. The world needs inflation.

one idea?

What if the ECB starts buying stocks like bank of japan or Swiss central bank?

I don't have enough stock exposure!

Europe loves the easy way

Friday, July 05, 2019

Francisco

0 Comments

TAGS:

Bank of England governor Mark Carney has said funds that invest in illiquid assets but allow investors instant access to their money are “built on a lie” and called for changes to regulations. ... “These funds are built on a lie, which is you can have daily liquidity,” Mr Carney told MPs at a parliamentary hearing.Jun 26, 2019Friday, July 05, 2019 Francisco 0 Comments

TAGS:

This is a big deal. You can see something that could be systemic,” he told the cross-party Treasury Select Committee. “These funds are built on a lie, which is that you can have daily liquidity for assets that fundamentally aren’t liquid.”

In Europe instead of making difficult to invest in Hedge Funds and other complex instruments the regulators are packaging complex things in UCITS or ETF's and the client believes he has daily liquidity until he has a surprise.

what should the regulators do?

Clearly setting the investor liquidity with a marging for a lack of perfert markets.

to let any product with credit to have daily liquidity for the investor is ridiculos. It's a lie

Europe loves the easy way, UCITS it's the easy way. The hard way would be to buy certain complex instruments clients must accept quarterly liquidity (or whatever is appropriate). If they might need the money in a hurry they are not suitable for the product.

easy way = Problems and surprises later

hard way= difficult sell but no surprises

The reflation trade has killed many people

Tuesday, July 02, 2019

Francisco

0 Comments

TAGS:

Two ideas from 2 smart guys,Tuesday, July 02, 2019 Francisco 0 Comments

TAGS:

1. Central banks will ultimately generate inflation and

2.Central banks can't generate inflation because globalization and technology are preventing it.

My take is, if USD goes down Emerging markets will boom and when these countries have money to spend they spend. Not like in Developed countries that people already have 3 cars and everything. When i see EM doing great inflation will come. Until that i will stick with A Gary Shilling

Chronic Low Inflation

As Insight readers know, we’ve been

predicting chronic low inflation, if not

deflation, for years. Worldwide

supplies of almost everything exceed

demand, pushing prices down.

Globalization has restrained U.S. wages

despite the 3.6% unemployment rate as

Western technology is combined with

cheap Chinese and other Asian labor.

Uber and other on-demand businesses

also depress labor rates while smart

phones and Amazon reduce prices of

all competing goods to the lowest

offering.

A Gary Shilling

Fed policy is likely to proceed in two

stages: An initial stage characterized

by a highly accommodative monetary

policy, followed by a second stage

where the Fed is raising rates aggressively

in response to galloping

inflation.

Peter Berezin, from the great BCA service

Subscribe to:

Posts (Atom)

Popular Posts

-

A $300 or a $30 watch both tell the same time!

A $300 or a $30 watch both tell the same time!

-

Warren Buffet says if you went to a parade and ......

-

There are two distinct periods in every man’s life:

-

A good way to be promoted = stand tall & go to the GYM

A good way to be promoted = stand tall & go to the GYM

-

I was wrong on this

I was wrong on this

-

My meeting with David Swensen in 2004

-

How can you be wealthier than the person ......

How can you be wealthier than the person ......

-

Big Money Thinks Small

-

Sitting is the new smoking

-

Stand alone to win BIG

Stand alone to win BIG

Blog Archive

-

▼

2019

(148)

-

▼

July

(15)

- Who wins the Champions league'

- Money is pretty good predictor of who will win ele...

- More money generally means more wins

- The Case for 50bps

- BAD -- Worry about appearing good

- Economics 101 lesson 3

- Economics 101 lesson 2

- Economics 101 lesson 1

- The Chinese miracle! Old fashion Credit......

- I did warn in advance now its a bit too late

- I want to thank my first five clients

- Why the fed is going to cut ......

- What if the ECB starts buying stocks

- Europe loves the easy way

- The reflation trade has killed many people

-

▼

July

(15)

Followers

Powered by Blogger.

0 comentários: